Top 40 Best Tax Havens & Offshore Service Providers

"Our country is wherever we are well off." - John Milton.

"The hardest thing in the world to understand is the income tax." - Albert Einstein.

"There is no such thing as a good tax." - Winston Churchill.

"Luxury is liberty. I never settle in anywhere, I've chosen liberty." - Coco Chanel.

"To be governed is to be watched, inspected, spied upon, directed, law-ridden, regulated, penned up, indoctrinated, preached at, checked, appraised, seized, censured, commanded, by beings who have neither title, nor knowledge, nor virtue.

To be governed is to have every operation, every transaction, every movement, noted, registered, counted, rated, stamped, measured, numbered, assessed, licensed, refused, authorized, endorsed, admonished, prevented, reformed, redressed, corrected." - Pierre-Joseph Proudhon.

"A wise and frugal government, which shall restrain men from injuring one another, which shall leave them otherwise free to regulate their own

pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned. This is the sum of good government." - Thomas Jefferson.

A TAX HAVEN is a country or territory where certain taxes are levied at a low rate or not at all. Individuals and/or corporate entities can find it attractive to move themselves to areas with reduced or nil taxation levels. This creates a situation of tax competition among governments. Different jurisdictions tend to be havens for different types of taxes, and for different categories of people and/or companies.

The following characteristics are indicative of a tax haven: nil or nominal taxes; lack of effective exchange of tax information with foreign tax authorities; lack of transparency in the operation of legislative, legal or administrative provisions; no requirement for a substantive local presence; and self-promotion as an offshore financial center. An offshore financial center, although not precisely defined, is usually a low-tax, lightly regulated jurisdiction which specializes in providing the corporate and commercial infrastructure to facilitate the use of that jurisdiction for the formation of offshore companies and for the investment of offshore funds.

An OFFSHORE FINANCIAL CENTER (or OFC), although not precisely defined, is usually a small, low-tax jurisdiction specialising in providing the corporate and commercial services to non-residents in the form of offshore companies and the investment of offshore funds.

- 2 Principalities see eye to eye on taxes - "A tax treaty, aimed at eliminating double taxation with respect to income tax and preventing tax evasion, has been signed between the Principality of Monaco and the Principality of Andorra."

- 12 Countries Where You Can Buy Citizenship (and a second Passport) - "After the 2016 presidential election, so many people were dreaming about moving out of the US that Canada’s immigration website crashed. Now, the idea of becoming an expat is getting hot again. According to a recent YouGov survey, 31% of Americans say they are interested in bolting if their candidate isn’t elected in the upcoming November elections. Tom Hanks and Rita Wilson made headlines when they recently became honorary Greek citizens and received passports."

- 2020 best countries - Rankings, News, Country Profiles - "Best Countries is a rankings, news and analysis project created to capture how countries are perceived on a global scale. The rankings evaluate 73 countries across 24 rankings drawn from a survey of more than 20,000 global citizens, measuring 75 dimensions that have the potential to drive trade, travel and investment and directly affect national economies."

- A simple guide to the Pandora Papers leak - "The Pandora Papers is a leak of almost 12 million documents that reveals hidden wealth, tax avoidance and, in some cases, money laundering by some of the world's rich and powerful."

- analysis of everyday expat life in more than 60 countries - InterNations.

- AngloINFO French Riviera - "The global expat network." Everything you need for life on the Côte d’Azur - local information you can trust. There are many reasons why people move away from their home country: career opportunities, temporary expat job assignments, study, retirement, an improved quality of life, family commitments, second-home ownership or permanent emigration. Whatever the reason for moving, life in a new place can be unusual, complicated or just difficult. Whether you have been living abroad for ten years or you are just thinking about moving, AngloINFO is here to give you dependable support - whenever and wherever you need it.

- Best & worst passports to hold in 2020 - "Henley Index: Japan tops 2020 list of world's most powerful passports."

- Best & Worst Places for Retirement - The New York Times.

- Best Passports To Have For Unrestricted Travel Around The World - The Henley & Partners Visa Restrictions Index.

- Best Places To Retire Abroad In 2020 - Forbes.

- big U.S. tax dodging is done in full public view - Quartz.

- British Virgin Islands - the world's leading offshore haven. The Guardian: Offshore Secrets.

- cellist who holds key to tracing Putin’s hidden fortune - The Guardian.

- CIA: THE WORLD FACTBOOK - provides information on the history, people, government, economy, geography, communications, transportation, military, and transnational issues for 266 world entities.

- Citizenship by Investment Program - St. Kitts & Nevis.

- Corporate Tax Haven Index - "Ranks the world’s most important tax havens for multinational corporations, according to how aggressively and how extensively each jurisdiction contributes to helping the world’s multinational enterprises escape paying tax, and erodes the tax revenues of other countries around the world."

- DEATH & TAXES - Benjamin Franklin.

- Death & Taxes (1 Page Book) [Poster]

- Amazon.com. - Amazon.com.

- Double Irish arrangement - "'Dutch Sandwich' saves Google, Apple and many other U.S. companies billions in taxes."

- EB-5 visa | Green Card program - immigrant Investors is a United States visa created by the Immigration Act of 1990. Under the federal program, a foreigner who invests US$500,000 — and in some instances, US$1 million — in a project that will create at least 10 jobs can apply for a green card. It generally takes from 22 to 26 months to obtain legal residency through the program, as opposed to several years for other visa programs.

- Egmont Group - since 1995. Informal international network of financial intelligence units (FIUs). "The goal of the Egmont Group is to provide a forum for FIUs around the world to improve cooperation in the fight against money laundering and the financing of terrorism and to foster the implementation of domestic programs in this field."

- EU’s net starts to close on tax havens - The Guardian.

- European banks storing €20bn a year in tax havens - "Barclays and HSBC among banks booking money equivalent to 14% of annual profits in offshore entities."

- EXPATIFY.COM - Inspiring Expatriatism. "We are the types of people who are always dreaming of living someplace else. It’s like dreaming about traveling, but more about dreaming becoming a part of a culture and experiencing what life is like in foreign (for now) places. With these dreams, we hope to inspire people to dream, investigate and experience what life is like in their choice of foreign country."

- Financial Secrecy Index - "Ranks jurisdictions according to their secrecy and the scale of their offshore financial activities. A politically neutral ranking, it is a tool for understanding global financial secrecy, tax havens or secrecy jurisdictions, and illicit financial flows or capital flight."

- Find out who’s behind almost 320,000 offshore companies & trusts from the Panama Papers - Offshore Leaks Database.

- FIVE FLAGS THEORY - definition & explanation.

- G20 backs crackdown on multinationals’ use of tax havens - "Finance chiefs endorse landmark move to prevent profits being shifted to low-tax countries."

- George Bolton - (1900-1982). British banker who was noted for his expertise in the foreign exchange market and as a leading influence on the rebirth of London after the Second World War. He served as director of the Bank of England, chairman for the Bank of London and South America and executive director of the International Monetary Fund. "George Bolton had a smart idea in 1958 for expanding the scope and profitability of the financial services sector in London. He developmed the Euro-dollar and the City of London began a new phase of its development - as a global hub for 'offshore' financial dealings, tax havens and fiscal paradises."

- Global Passport Power Rank 2017 - ranked by total visa-free score.

- Global super-rich has at least US$21 trillion hidden in secret tax havens - The Guardian.

- Global Travel Freedom at a Glance - The Henley & Partners Restrictions Index 2016.

- Global Wealth Report 2013 - Credit Suisse.

- 'Golden passports' threaten European security, warns EU commissioner - "‘Citizenship for sale’ under increasing scrutiny from governments and security agencies."

- GOOGLE'S TAX LOOPHOLE - the "Double Irish" and the "Dutch Sandwich" strategy.

- Guano Islands Act - a United States federal law passed by the U.S. Congress that enables citizens of the United States to take possession of unclaimed islands containing guano deposits. The islands can be located anywhere, so long as they are not occupied and not within the jurisdiction of another government. It also empowers the President of the United States to use the military to protect such interests and establishes the criminal jurisdiction of the United States in these territories.

- Henley Passport Index 2006-2019 - "The Henley Passport Index is the original ranking of all the world’s passports according to the number of destinations their holders can access without a prior visa. The ranking is based on exclusive data from the International Air Transport Association (IATA), which maintains the world’s largest and most accurate database of travel information, and enhanced by ongoing research by the Henley & Partners Research Department."

- How Apple - and the Rest of Silicon Valley - Avoids the Tax Man - Wired.

- How Billion-Dollar Companies Paid Nothing in Taxes - The New York Times.

- How Donald Trump Turned the Tax Code Into a Giant Tax Shelter - The New York Times.

- How offshore firm helped billionaire change the art world for ever - The Guardian.

- How the U.S. became one of the world’s biggest tax havens - The Washington Post.

- how the world’s rich & famous hide their money offshore - The Guardian.

- How to explain offshore banking to a 5 year old - The Guardian.

- How to Hide $400 Million - The New York Times.

- How to hide it: inside secret world of wealth managers - The Guardian.

- How Wealthy People Protect Their Money - The Atlantic.

- ICIJ offshore Leaks Database - The International Consortium of Investigative Journalists.

- ICIJ releases The Paradise Papers - ICIJ.

- In wake of Brexit, EU to put Cayman Islands on tax haven blacklist - "Decision on British overseas territory comes less than two weeks after UK left bloc."

- Inheritance tax, & how the Dukes of Westminster avoid it - The Telegraph.

- Inside the Secretive World of Tax-Avoidance Experts - The Atlantic.

- International Visa Restrictions - Henley & Partners.

- InterNations - "Connecting Global Minds." Community for expatriates & global minds. Enjoy the international experience with fellow global minds. Making life easier for expats. Helps expats to feel at home abroad, meet people and find information about their new environment.

- INTRODUCTION TO GOING OFFSHORE - Tax Haven Manual.

- Investor Citizenship ("golden passport") Schemes - "Questions and Answers on the Report on Investor Citizenship and Residence Schemes in the European Union."

- IRELAND: TAX REGIME - IDA Ireland Investment Promotion Agency.

- Leaked Documents Expose Global Companies’ Secret Tax Deals in Luxembourg - ICIJ.

- Liberland - sovereign state located between Croatia and Serbia on the west bank of the Danube river.

- List of people with non-domiciled status in the UK - Wikipedia.

- Luxembourg tax files: how tiny state rubber-stamped tax avoidance on an industrial scale - The Guardian.

- LuxLeaks - the name of a journalistic investigation conducted by the International Consortium of Investigative Journalists, based on confidential information about tax rulings from 2002 to 2010 enabling global transfer pricing arrangements.

- MAILDROPS & SERVICED OFFICES - definition & explanation.

- Maltese passports: why the uber-rich are desperate to have one - "A passport from this country is 'the latest status symbol'. And the world’s wealthiest people are lining up for one."

- Mapped: Where in the world is safe from terror? - The Telegraph.

- MOBILE WEALTHY RESIDENCY INDEX - definition & explanation.

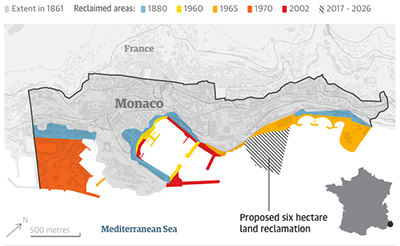

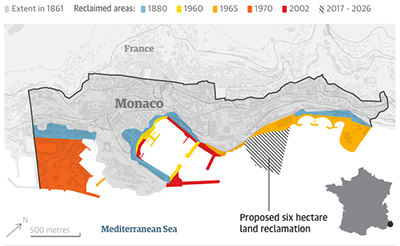

- Monaco builds into the Med to house new throng of super-rich - The Guardian.

- Monaco officially added to ‘money laundering’ grey list - "The Financial Action Task Force (FATF), the global anti-money laundering watchdog, announced on Friday, June 28 that Monaco has been added to its ‘grey list’ of countries subject to increased monitoring. The Principality is the highest profile European jurisdiction to be added to the FATF grey list in years."

- Monaco's inhabitants' average life expectancy is 89.52 years - the longest in the world - The World Factbook.

- Moneyval - term by which, both commonly and officially, is known the Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism, a monitoring body of the Council of Europe.

- Mossack Fonseca: inside the firm that helps the super-rich hide their money - The Guardian.

- Nevis: how the world’s most secretive offshore haven refuses to clean up - The Guardian.

- Non-Dom tax rule - definition & explanation.

- non-domiciled status - sometimes called a 'non-dom', is a person living in the United Kingdom who has either acquired a foreign domicile from their father, which is known as a 'domicile of origin', or who has abandoned their domicile of origin and can demonstrate the intention to reside outside of the UK indefinitely and actually enacts the intention.

- OFFSHORE COMPANY - Wikipedia.

- OFFSHORE Leaks - the name of a financial scandal that unmasked details of 130,000 offshore accounts in April 2013.

- Panama faces pressure to come into the fold - "Panama is one of just four jurisdictions — along with Bahrain, Nauru and Vanuatu — that have refused to sign up."

- Panama joins international efforts against tax evasion & avoidance - OECD.

- Panama papers: the names - "Search our database of 37,000 names linked to Mossack Fonseca companies in the tax haven of Panama." The Sunday Times.

- Pandora Papers - "The largest investigation in journalism history exposes a shadow financial system that benefits the world’s most rich and powerful. Read more." International Consortium of Investigative Journalists (ICIJ).

- Pandora papers: biggest ever leak of offshore data exposes financial secrets of rich & powerful - "Millions of documents reveal offshore deals and assets of more than 100 billionaires, 30 world leaders and 300 public officials."

- Paradise Papers - Wikipedia.

- Passport Index 2017 - "Passports of the world ranked by their total visa-free score."

- Passports for purchase: Open citizenship doors around the world - "Need a new passport? These countries will sell you one -- if you can afford it."

- Private Bank Fuels Fortunes of Putin’s Inner Circle - The New York Times.

- PROJECT UTOPIA - BMT Nigel Gee Ltd.

- Rise in number of world's rich buying UK 'golden visas' - "The number of wealthy foreigners investing at least £2m in the UK in exchange for a 'golden visa' has risen to a five-year high, despite a clampdown on the scheme in the aftermath of the Skripal novichok poisoning attack."

- St. Kitts & Nevis Citizenship by Investment Program - "The Citizenship-by-Investment Program was established in 1984, making it the longest established program of this kind in the world."

- PT - THE PERPETUAL TRAVELER - definition & explanation.

- Revealed: the $2bn offshore trail that leads to Vladimir Putin - The Guardian.

- Secret Files Expose Offshore’s Global Impact - ICIJ.

- Secrets of Surveillance Capitalism - Frankfurter Allgemeine Zeitung.

- Surge in passport sales delivers Vanuatu a record budget surplus - "Economy devastated by Covid shutdowns and a destructive cyclone, but citizenships-for-sale are keeping the country afloat. Vanuatu citizenship costs US$130,000."

- Switzerland: Best Country in the World - The New York Times.

- TAX AVOIDANCE AND TAX EVASION - Wikipedia.

- Tax evasion: blacklist of 21 countries with 'golden passport' schemes published - "OECD says schemes selling either residency or citizenship threaten efforts to combat tax evasion."

- Tax exile - person who leaves a country to avoid the payment of income tax or other taxes. It is a person who already owes money to the tax authorities or wishes to avoid being liable in the future to taxation at what they consider high tax rates, instead choosing to reside in a foreign country or jurisdiction which has no taxes or lower tax rates. In general, there is no extradition agreement between countries which covers extradition for outstanding tax liabilities.

- Tax havens explained: How the rich hide money - interactive.

- TAX JUSTICE NETWORK | TJN - independent organisation dedicated to high-level research, analysis and advocacy in the field of tax and regulation. We work to map, analyse and explain the role of taxation and the harmful impacts of tax evasion, tax avoidance, tax competition and tax havens.

- The 1 Percent: Secrets of global elite revealed - ICIJ.

- THE AL CAPONE METHOD - definition & explanation.

- teddy bear test & other challenges facing the rich who try to flee high-tax states - Los Angeles Times.

- THE AMBASSADOR - Danish documentary about how to obtain a legal diplomatic passport in Liberia.

- The Complicated Truth About What U.S. Citizenship Means Today - TIME Magazine.

- The Panama Papers - "Politicians, Criminals and the Rogue Industry That Hides Their Cash." ICIJ.

- The passport king who markets citizenship for cash - "Guardian investigation reveals how a small firm of wealth advisers built up a $3bn ‘golden passports’ industry and gained influence in the Caribbean."

- THE PRICE OF OFFSHORE REVISITED -

"Global super-rich has at least US$21 trillion hidden in secret tax havens." The research was undertaken for the Tax Justice Network by former McKinsey & Company chief economist James Henry.

- The Privacy Surgeon - "Dissecting the issues that matter to you."

- Top 10 Most Expensive Places To Live In The World - TheRichest.org

- Trouble in paradise: Family, feuds & fraud in Jersey - "The wealthy Dick family are set for a court battle that could shine an unwelcome light on the world of offshore trusts."

- UK & territories are 'greatest enabler' of tax avoidance, study says - "The UK and its 'corporate tax haven network' is by far the world’s greatest enabler of corporate tax avoidance, research has claimed."

- UK climbs ranking of tax havens - "Tax Justice Network says UK is nearing top 10 most secretive financial systems."

- Ultimate Passport Ranking - GoEuro.

- U.S. Companies Hold Trillions of dollars of Profits Offshore - The New York Times.

- US corporations have $1.4tn hidden in tax havens, claims Oxfam report - The Guardian.

- Visa Restrictions Index & best passports 2016 - Henley & Partners.

- Visa Restriction Index 2007 to 2017 - Henley & Partners.

- Wealth Inequality Rising Fast, Oxfam Says, Faulting Tax Havens - The New York Times.

- Wealthy Norwegians Are Moving To This Remote Tax Haven - Forbes.

- What are The Panama Papers? - Biggest Leak in History.

- When can you legally travel without a passport? - BBC News.

- Why John Cleese is leaving the UK for Nevis - BBC News.

- world's cheapest places to emigrate to - The Telegraph.

- world's most corrupt countries - The Telegraph.

- world's most powerful passports for 2017 - The Telegraph.

- world's rarest passport has only 3 holders - The Sovereign Military Order of Malta.

- Your very own, portable, Tropical Island Paradise - Gizmag.

Bookstore

- Asset Protection : Concepts and Strategies for Protecting Your Wealth

- by Jay Adkisson. - by Jay Adkisson.

- Asset Protection (Entrepreneur Legal Guides)

- by Robert Klueger. - by Robert Klueger.

- Asset Protection... In Financially Unsafe Times

- by Arnold S. Golstein. - by Arnold S. Golstein.

- Asset Protection Planning Guide, Second Edition

- by Barry S. Engel. - by Barry S. Engel.

- Asset Protection Strategies: Wealth Preservation Planning With Domestic And Offshore Entities Volume II

- by Alexander A., Jr. Bove. - by Alexander A., Jr. Bove.

- Bulletproof Asset Protection

- by William S. Reed. - by William S. Reed.

- Bulletproof Offshore Asset Protection

- by Jim Bennett. - by Jim Bennett.

- Capital without Borders: Wealth Managers and the One Percent - by Brooke Harrington.

- Fundamentals Of Offshore Banking: How To Open Accounts Almost Anywhere

- by Walter Tyndale. - by Walter Tyndale.

- Global Private Banking and Wealth Management: The New Realities (The Wiley Finance Series)

- by David Maude. - by David Maude.

- Hide Your Assets and Disappear: A Step-by-Step Guide to Vanishing Without a Trace

- by Edmund Pankau. - by Edmund Pankau.

- How I Found Freedom in an Unfree World: A Handbook for Personal Liberty

- by Harry Browne. - by Harry Browne.

- How to Be Invisible: The Essential Guide to Protecting Your Personal Privacy, Your Assets, and Your Life

- by J. J. Luna. - by J. J. Luna.

- How To Start Your Own Country

- a book about micronations and new country projects by Erwin S Strauss. It is generally considered to be the first attempt at documenting micronations as a global phenomenon. - a book about micronations and new country projects by Erwin S Strauss. It is generally considered to be the first attempt at documenting micronations as a global phenomenon.

- International Trust Laws

- by Paolo Panico. - by Paolo Panico.

- Investing Offshore: Secrets Of Asset Protection

- by Robert Forbush. - by Robert Forbush.

- Legal Offshore Tax Havens: How to Take LEGAL Advantage of the IRS Code and Pay Less in Taxes

- by Jesse Schmitt. - by Jesse Schmitt.

- Lawyers Are Liars: The Truth About Protecting Our Assets

- by Mark J. Kohler. - by Mark J. Kohler.

- Non-Resident & Offshore Tax Planning

- by Lee Hadnum. - by Lee Hadnum.

- Offshore Advantage : A Canadian Guide to Wealth Creation, Asset Protection, and Estate Planning

- by Gordon Laight. - by Gordon Laight.

- Offshore Asset Protection for Busy Professionals

- by James Bennett. - by James Bennett.

- Offshore Business Centres: A World Survey, (Formerly Grundy's Tax Havens

- by Milton Grundy. - by Milton Grundy.

- Offshore Havens

- by Arnold S. Goldstein. - by Arnold S. Goldstein.

- Offshore Investments that Safeguard Your Cash: Learn How Savvy Investors Grow and Protect Their Wealth

- by Erika Nolan. - by Erika Nolan.

- Offshore Investments: The Millionaire Vision

- by Raj D. Rajpal. - by Raj D. Rajpal.

- Offshore Investing (Made E-Z Guides)

- by Arnold S. Goldstein. - by Arnold S. Goldstein.

- Offshore Money Book, The: How to Move Assets Offshore for Privacy, Protection, and Tax Advantage

- by Arnold Cornez. - by Arnold Cornez.

- Offshore: The Tax Free World - The Indispensible Guide to Offshore Financial World

- by Scott M. Smathers. - by Scott M. Smathers.

- Offshore Trusts, Your Key to Flexible Asset Protection

- by Robert E. Bauman. - by Robert E. Bauman.

- Questions Great Financial Advisors Ask... and Investors Need to Know

- by Alan Parisse. - by Alan Parisse.

- Safe Harbors: An Asset Protection Guide for Small Business Owners (Business Owner's Toolkit series)

- by Nicolas C. Masenti. - by Nicolas C. Masenti.

- Secrets of Swiss Banking: An Owner's Manual to Quietly Building a Fortune

- by Hoyt Barber. - by Hoyt Barber.

- So Sue Me! How to Protect Your Assets from the Lawsuit Explosion

- by Arnold S. Goldstein. - by Arnold S. Goldstein.

- Strategies for Protecting Wealth

- by Darrell Aviss. - by Darrell Aviss.

- Tax Avoidance: Barter, Tax Haven, Tax Avoidance and Tax Evasion, Transfer Pricing, 2008 Liechtenstein Tax Affair, Tax Rates Around the World

- by Books LLC. - by Books LLC.

- TAX HAVEN MANUAL - since 1975.

- Tax Haven Roadmap

- by Richard Czerlau. - by Richard Czerlau.

- Tax Havens: How Globalization Really Works (Cornell Studies in Money)

- by Ronen Palan, Richard Murphy and Christian Chavagneux. - by Ronen Palan, Richard Murphy and Christian Chavagneux.

- Tax Havens of the World - by Walther & Dorothy Diamond. Examines tax havens in over 70 countries and territories around the world.

- Tax Havens of the World, Eighth Edition

- by Thomas Azzara. - by Thomas Azzara.

- Tax Havens Today: The Benefits and Pitfalls of Banking and Investing Offshore

- by Hoyt L. Barber. - by Hoyt L. Barber.

- Tax Rates Around the World: List of Countries by Tax Revenue as Percentage of GDP, Dividend Imputation, Tax Freedom Day, Welfare State, Tax Haven

- by Lambert M. Surhone, Miriam T. Timpledon and Susan F. Marseken. - by Lambert M. Surhone, Miriam T. Timpledon and Susan F. Marseken.

- The Complete Book of Trusts, 3rd Edition

- by Martin M. Shenkman. - by Martin M. Shenkman.

- The Complete Tax Guide for Real Estate Investors: A Step-By-Step Plan to Limit Your Taxes Legally

- by Jackie Sonnenberg. - by Jackie Sonnenberg.

- The Consumer's Guide to Swiss Annuities

- by Jean-Francois Meillard. - by Jean-Francois Meillard.

- The Doctor's Wealth Preservation Guide

- by Roccy DeFrancesco. - by Roccy DeFrancesco.

- The Great Tax Robbery - How Britain Became A Tax Haven

- by Richard Brooks. - by Richard Brooks.

- The Heavens: Annual Report

- by Paolo Woods (Photographer), Gabriele Galimberti (Photographer). Woods and Galimberti's photographs reveal a world of exploitation and privilege that distorts the financial markets and benefits those that already have the most. The book is presented as if it were an annual report and text by author Nicholas Shaxson presents a clear insight into how these tax havens feed into the global economy and impact our everyday lives. - by Paolo Woods (Photographer), Gabriele Galimberti (Photographer). Woods and Galimberti's photographs reveal a world of exploitation and privilege that distorts the financial markets and benefits those that already have the most. The book is presented as if it were an annual report and text by author Nicholas Shaxson presents a clear insight into how these tax havens feed into the global economy and impact our everyday lives.

- The International Man

- by Douglas R. Casey. - by Douglas R. Casey.

- The Law of Offshore Asset Protection

- by Christopher Hunter. - by Christopher Hunter.

- The Offshore Asset Protection Workbook

- by Alan Stang. - by Alan Stang.

- The Offshore Counsellor: Asset Protection

- by Thomas Malcolm. - by Thomas Malcolm.

- The PPLI Solution: Delivering Wealth Accumulation, Tax Efficiency, and Asset Protection Through Private Placement Life Insurance

- by Kirk Loury. - by Kirk Loury.

- The Private Interest Foundation of Panama (Harris, Marc M. Harris Offshore Manual.)

- by Marc M. Harris. - by Marc M. Harris.

- The Real Estate Investor's Guide to Corporations, LLCs, and Asset Protection Entities

- by Richard T. Williamson. - by Richard T. Williamson.

- The Ultimate Guide to Offshore Tax Havens

- by Samuel Blankson. - by Samuel Blankson.

- The World of Tax Havens

- by Lucio Velo. - by Lucio Velo.

- The World's Best Tax Havens: How to Cut Your Taxes to Zero and Safeguard Your Financial Freedom

- by Lee Hadnum. - by Lee Hadnum.

- Treasure Islands: Tax Havens and the Men Who Stole the World

- by Nicholas Shaxson. - by Nicholas Shaxson.

- Trump University Asset Protection 101

- by J. J. Childers. - by J. J. Childers.

- Trusts and Related Tax Issues in Offshore Financial Law

- by Rose-Marie Belle Antoine. - by Rose-Marie Belle Antoine.

- Using Offshore Havens for Privacy & Profit: Revised and Updated Edition

- by Adam Starchild. - by Adam Starchild.

- Wealth Management: The Financial Advisor's Guide to Investing and Managing Client Assets

- by Harold Evensky. - by Harold Evensky.

Offshore Service Providers

- 10 SMALLEST COUNTRIES IN THE WORLD - Expatify.com.

- 50-gram CombiBar - "Is There Gold in Your Wallet?" Due to global banking and European currency crises, more and more investors have started to demand a higher number of small bars rather than few larger ones to increase their flexibility in the event of an economic crisis. CombiBars are similar in dimension to a credit card. Their convenient size means that a Combi Bar can be easily and discreetly carried in your wallet. Just like standard bullion, CombiBars and the individual bars from the CombiBars can be sold at any time to precious metal dealers at the current purchasing rates.

- A.C.T. Offshore in Seychelles - "We specialize in the formation and administrative support of Seychelles international business companies (IBCs). We have been assisting clients particularly via their professional advisors, planners, wealth managers and other intermediaries since 1995 and we are known for being one of the fastest, friendliest and easiest agents in Seychelles to work with."

- Alpes Domiciliation & FormalitÉs - domiciliation and the administrative services.

- Alter Domus - founded in Luxembourg in 2003, Alter Domus has continually expanded its global service offer and today counts 28 offices and desks across four continents. "We are a leading European provider of Fund and Corporate Services, dedicated to international private equity & infrastructure houses, real estate firms, multinationals, private clients and private debt managers. Our vertically integrated approach offers tailor-made administration solutions across the entire value chain of investment structures, from fund level down to local Special Purpose Vehicles."

- ANGUILLA CARIBBEAN HAVEN - international tax planning Bahamas, Anguilla.

- BELIZE OFFSHORE COMPANY FORMATION

- BUSINESS CENTRE - whether you need a small executive suite or an entire floor of serviced office space, Avanta's flexible business centres throughout prime areas of London and the UK provide the solution.

- BYE BYE BIG BROTHER - "The Bible of "Perpetual Traveler" theory and practice, backed by decades of experience." Only 500 copies of Bye Bye Big Brother were printed. When the remaining copies are gone, they are gone for ever as BBBB will not be reprinted.

- CAPITAL CONSERVATOR - open your offshore bank account online.

- Casey Research - "Personal Freedom Through Financial Freedom."

- Commonwealth Trust Limited - since 1994. British Virgin Islands.

- CREDIT CARDS AUSTRALIA - compare & apply for a credit card online.

- DICÈNT S.A. - affordable offshore company formation in Switzerland, with Swiss bank account.

- EMBASSY WorldWide - "Absolutely all of the world's embassies in a searchable database." Embassies & consulates of the world.

- EOFFICE - access 200+ locations in more than 60 countries in 40 cities. Office spade, offices for rent, serviced offices, meeting rooms, conference rooms, virtual offices.

- ESCAPE ARTIST - "Live, Work, Play, Retire & Invest Abroad."

- EXPAT INTERVIEWS - interviews with people (expats) living overseas and abroad.

- EXPAT NETWORK - "25 Years of Excellence Serving the Expatriate Community."

- EXPATIFY.COM - "Travel & Expat Blog, Community & Lifestyle Magazine."

- Fidelity Overseas - professional provider of offshore company registrations in Belize.

- FIDEX GROUP S.A. - since 1982. Panama incorporation services.

- Find out who’s behind almost 320,000 offshore companies & trusts from the Panama Papers - Offshore Leaks Database.

- FORMATIONS HOUSE - "Online company formation in UK and limited company registration."

- FRANK M. AHEARN - the leader in teaching people how to disappear. For over twenty years Frank M. Ahearn has been considered one of the leading skip tracers in the world.

- G.S.L. Law & Consulting - have been providing services in the fields of offshore company incorporation, bank account opening, registered office address services since 2001.

- GLOBAL MONEY CONSULTANTS - "The Offshore Specialists."

- HAWALA BANKING - definition & explanation.

- Hill Consulting Ltd. - Moscow, Russia.

- How to Hide $400 Million - The New York Times.

- IBCC - "Forming Companies Worldwide Since 1994." From Dublin to Moscow, IBCC is your global company formation partner.

- INTERNATIONAL LIVING - since 1979. "Live, Retire and Invest Overseas."

- international man - "Making the Most of Your Personal Freedom and Financial Opportunity Around the World." Doug Casey's International Man is dedicated to bringing you highly actionable solutions to protect yourself — and even profit — from destructive government actions.

- INTERNATIONAL MONETARY FUND - home page.

- JCONNECT - "Fax and Voicemail by Email."

- KATHLEEN PEDDICORD - founder and publisher: "Live and Invest Overseas."

- Le Freeport - "A high-end, ultra safe facility for the storage of valuable goods." LE FREEPORT sets new standards, demanded by investors and collectors alike: a purpose built facility combining cutting edge technology, efficient logistics, and an exhaustive range of expert services. LE FREEPORT is the ideal platform for securing, servicing and selling works of art and other valuables. Luxembourg & Singapore.

- Liberland - sovereign state located between Croatia and Serbia on the west bank of the Danube river.

- MY TAX HAVEN - "The Offshore Yellow Pages Professional Services Directory."

- NESTMANN - "The Nestmann Group is US-based with European and Caribbean representative offices and specialises in second citizenship and alternative residence, immigration, and expatriation for high net worth international clients."

- NIC LAW ENFORCEMENT SUPPLY - "At NIC you can get professional identification, gear from brands you trust, and shop online 24/7 from our large selection of stock badges, clothing, and ID you won't find anywhere else."

- OCRA WORLDWIDE | OFFSHORE COMPANY FORMATION - since 1975. "We have established and administered over 200,000 companies and trusts worldwide from 20 global offices and take pride in giving value and personal service to the international business and professional community."

- OFFSHORE ASSET PROTECTION - EscapeArtist.

- OFFSHORE COMPANIES HOUSE - "Ready-Made (Shelf) Offshore Companies Price List."

- OFFSHORE COMPANY, INC. - "Confidential Offshore Services since 1977."

- OFFSHORE CORPORATION - "World´s Largest Offshore Incorporator." Confidential offshore services since 1977.

- OFFSHORE NET - "Offshore Business News."

- OFFSHORE SIMPLE - "Professional offshore incorporations and offshore banking services since 1996."

- PAY PAL - "Send Money, Pay Online or Set Up a Merchant Account with PayPal."

- Portcullis TrustNet - Asia's biggest independent group of trust companies for comprehensive wealth administration. "We are a one-stop shop employing: lawyers and accountants;

trust, foundation and company administrators and fiduciaries

that offer corporate, trustee and fund administration services

to high net worth individuals, family offices, philanthropies, private banks,

investment managers and advisers."

- Privacy Management Group - "UAE (United Arab Emirates) & RAK (Emirate of Ras Al Khaimah) Offshore Company Formation & Registration."

- PRIVACY SOLUTIONS - "Offshore company formation and bank accounts opening. Offshore company services with web hosting and virtual office. Incorporating offshore IBC worldwide with complete support."

- Q WEALTH REPORT - "Find financial freedom offshore."

- REGUS - since 1989. "Work your way." 2,300 locations 750 cities 100 countries. Executive suite, virtual offices & conference room space.

- Roche & Duffay - Moscow, Russia.

- SCF GROUP | OFFSHORE COMPANY FORMATION WORLDWIDE - since 1989. "Licensed Company & Trust Managers." Offshore banking, tax planning, asset protection and offshore overseas property investments.

- SECURE TRUST COMPANIES - Swiss financial services provider.

- SHELTER OFFSHORE - "Examining offshore tax havens, their regulatory environments, and the investment, saving and banking opportunities available therein."

- SHINJIRU - "Started in 1998 with the aim of providing the highest privacy, protection and secure offshore web hosting services. We are the only offshore web hosting provider that has ISO9001:2008 quality assurance level, multiple awards and recognitions."

- Shorex Capital - "Citizenship by Investment Solutions."

- SOVEREIGN SOCIETY - since 1998. "Feel the freedom of total wealth." The Sovereign Society was conceived in 1998 by a group of four uncompromising advocates of liberty and free markets. We felt strongly that individuals are born sovereign over themselves, not as chattels of governments.

- STABIQ TREASURE HOUSE - "Your Safest Place." In times of swift political and social change and increased uncertainty on the financial markets, there is a growing desire for safety and consistency. Our Asset Protection Solutions offer our customers sustainable and reliable solutions as well as a safe haven. In collaboration with our attorney and trust company, we offer the opportunity of storing your valuable items such as gold and precious metals, works of art, jewellery, watches and coin collections in exclusive surroundings within an area of over 6000 m². At the same time, valuables can be presented, viewed and evaluated in our exclusive showrooms. The STABIQ Treasure House is also an Open Customs Warehouse (OCW) managed in accordance with the strict guidelines of the Swiss Customs Authority. Wirtschaftspark 27, 9492 Eschen, Liechtenstein.

- Startups.ch - online information and company foundation platform since October 2005. Over 8,000 Swiss companies have been successfully founded. STARTUPS.CH is represented in 20 different locations all over Switzerland, where STARTUPS.CH customers get advised and supported in the national languages as well as English.

- Swiss Bankers Travel Cash Card - no-name prepaid MasterCard is available to everyone; not tied to a bank account; no credit check; no forms to fill out; the card can only be charged when funds have been loaded n euros, US dollars and Swiss francs; safe and affordable withdrawals of funds at over 2 million ATMs worldwide; accepted by more than 33 million merchant locations and online shops worldwide; no annual fee.

- TAX HAVEN CO - "Offshore services including banking and company formation."

- TAX HAVEN MANUAL - since 1975.

- TAX HAVEN REPORTER - newsletter.

- THE COMPANY CORPORATION - since 1899. Incorporate for as little as US$99 in the U.S.

- The Offshore Game of Online Sports Betting - The New York Times.

- Über-warehouses for the ultra-rich - "Ever more wealth is being parked in fancy storage facilities. For some customers, they are an attractive new breed of tax haven."

- Ugland House - George Town, Cayman Islands. Located on South Church Street, the building is the registered office address for 19,000+ companies and has for years been linked to tax avoidance strategies.

- U.S. CORPORATION SERVICES - "Company Formations Since 1982."

- U.S. PROGRAM OF GREEN CARD LOTTERY - "Participate in the Official US Government D.V. Visa Lottery program now."

- UTOPIA - capacity: 206 spacious and luxurious hotel suites on board offer guests a truly unsurpassed experience on the seas. Planned luxury residential cruise ship project Utopia Residences with construction to be completed by 2014. Completion of the ship is expected in late 2014 at a cost of US$1.1 billion. Permanent luxury residences ranging from about $3.9 million to $26 million.

- WORLD SERVICE AUTHORITY - a non-profit organization founded by Garry Davis in 1954. Best known for issuing World Passports.

Professional Legal Services

- Dietrich, Baumgartner & Partner - since 1973. Zurich, Switzerland. Specialises in particular in international commercial and corporate law, including international company structures, domestic and non-domestic incorporations, and more.

- EFSAG | European Financial Services Advisory Group - leading provider of corporate and financial consultancy services. From standard services to tailor-made coverage across all lines of business and industries. Provides international company formation and management services in many jurisdictions worldwide.

- GVTH Advocates - "Law Firms in Malta." Citizenship by investment programme was introduced by Legal Notice 47 of 2014. The programme offers applicants and their family members the opportunity to acquire Maltese citizenship within a very short period of time and to enjoy all rights and benefits that any other Maltese national would enjoy, including the right to travel, work, study and reside in Malta and the European Union.

- Harneys - "Harneys Corporate Services delivers a full complement of corporate, trust and fiduciary services in the British Virgin Islands and the Cayman Islands."

- HENLEY & PARTNERS - "The Global Leaders in Residence and Citizenship Planning."

- MAALOUF ASHFORD & TALBOT - "A Law Firm Serving Global Clients." Named "Law Firm of the Year" in the United States for 2011 in the ACQ Law Awards.

- MARXER & PARTNER ATTORNEYS AT LAW - founded 1925. "The oldest and largest law firm in the Principality of Liechtenstein."

- MICHELOUD & CIE - "The Swiss specialist." Micheloud & Cie offers quality services to wealthy people who would like to relocate either physically or financially to Switzerland and other selected jurisdictions. Our services are top quality only and totally customized to the client's needs - all this at reasonable prices.

- MOSSACK FONSECA - "Established in 1977, the Mossack Fonseca Group is a leading global company which provides comprehensive legal, trust and accounting services. Mossack Fonseca’s team of executives can quickly and efficiently help you find the option that best suits your needs. If you require information about the most suitable alternative when it comes to choosing a company formation jurisdiction, our expertise and knowledge will be your best business allies.

- Mourant Ozannes - "One of the leading offshore law firms. We advise on the laws of the BVI, the Cayman Islands, Guernsey and Jersey."

- Offshore Services Lawyers & Law Firms in China - HG.org Legal Resources.

- Rosemont International - provides a full family office service to individuals and their families. We assist our clients in structuring and administering their assets in a tax efficient manner in compliance with international regulations.

- Starting Business - provides company formation and management services in various recommended jurisdictions worldwide.

- TAX RESIDENCES - international lawyer based in Monaco. Specializes in the following low tax jurisdictions: Monaco, England, Switzerland and Bahamas.

- THE COMPETENCE CENTER - Liechtenstein: "Your partner for managing money."

Tax Havens & Offshore International Financial Centers

- 17 things you didn't know about Panama, the world's happiest tax haven - The Telegraph.

- A Piketty ProtÉgÉ’s Theory on Tax Havens - The New York Times.

- British Virgin Islands - the world's leading offshore haven. The Guardian: Offshore Secrets.

- Cayman Islands – home to 100,000 companies - "Here are 10 facts about the world’s most notorious tax haven."

- Corporate Tax Haven Index 2019 - "Ranks the world’s most important tax havens for multinational corporations, according to how aggressively and how extensively each jurisdiction contributes to helping the world’s multinational enterprises escape paying tax, and erodes the tax revenues of other countries around the world."

- EU’s net starts to close on tax havens - The Guardian.

- Guano Islands Act - a United States federal law passed by the U.S. Congress that enables citizens of the United States to take possession of unclaimed islands containing guano deposits. The islands can be located anywhere, so long as they are not occupied and not within the jurisdiction of another government. It also empowers the President of the United States to use the military to protect such interests and establishes the criminal jurisdiction of the United States in these territories.

- How the U.S. became one of the world’s biggest tax havens - The Washington Post.

- In wake of Brexit, EU to put Cayman Islands on tax haven blacklist - "Decision on British overseas territory comes less than two weeks after UK left bloc."

- LIST OF UNCO-OPERATIVE TAX HAVENS - source: OECD.

- Maltese passports: why the uber-rich are desperate to have one - "A passport from this country is 'the latest status symbol'. And the world’s wealthiest people are lining up for one."

- Nevis: how the world’s most secretive offshore haven refuses to clean up - The Guardian.

- Panama faces pressure to come into the fold - "Panama is one of just four jurisdictions — along with Bahrain, Nauru and Vanuatu — that have refused to sign up."

- Switzerland: Best Country in the World - The New York Times.

- TAX HAVEN - Wikipedia.

- The great American tax haven: why the super-rich love South Dakota - "It’s known for being the home of Mount Rushmore - and not much else. But thanks to its relish for deregulation, the state is fast becoming the most profitable place for the mega-wealthy to park their billions."

- The world's most beautiful tax havens - The Telegraph.

- Trouble in paradise: Family, feuds & fraud in Jersey - "The wealthy Dick family are set for a court battle that could shine an unwelcome light on the world of offshore trusts."

- UK & territories are 'greatest enabler' of tax avoidance, study says - "The UK and its 'corporate tax haven network' is by far the world’s greatest enabler of corporate tax avoidance, research has claimed."

- UK climbs ranking of tax havens - "Tax Justice Network says UK is nearing top 10 most secretive financial systems."

- US corporations have $1.4tn hidden in tax havens, claims Oxfam report - The Guardian.

- Why John Cleese is leaving the UK for Nevis - BBC News.

- Why the super-rich buy Maltese passports - "Malta's 'golden passports': Why do the super-rich want them?"

|

|